Property Taxes

Updated May 29, 2024

The District of Sooke collects taxes for both the municipality and a number of other governing agencies, such as the Capital Regional District, the Regional Hospital District, and Schools (Provincial School Tax). Of the total property tax you pay, approximately 44% is applied to municipal services. The balance and majority of property taxes collected, approximately 56% are collected on behalf of and transferred to other taxing authorities.

Provincial legislation sets out very detailed regulations for municipal taxation.

Each year, property tax notices will be mailed in late May/early June. If, after June 10th, you have not received your property tax notice, please contact the Finance Department at 250.642.1634 before the due date. It is the responsibility of the property owner to pay property taxes by the due date in order to avoid a penalty, whether or not a bill was received. New owners who have not received a property tax notice are advised to contact the Finance Department.

Council determines how much money it must raise through property taxes and, this, together with the assessed value of the taxable property determines the tax rate. Tax rates are expressed in “dollars per thousand”. Current and historical tax rate information is linked below:

- 2024 Tax Rates

- 2023 Tax Rates

- 2022 Tax Rates

- 2021 Tax Rates

- 2020 Tax Rates

- 2019 Tax Rates

- 2018 Tax Rates

- 2017 Tax Rates

- 2016 Tax Rates

Resources

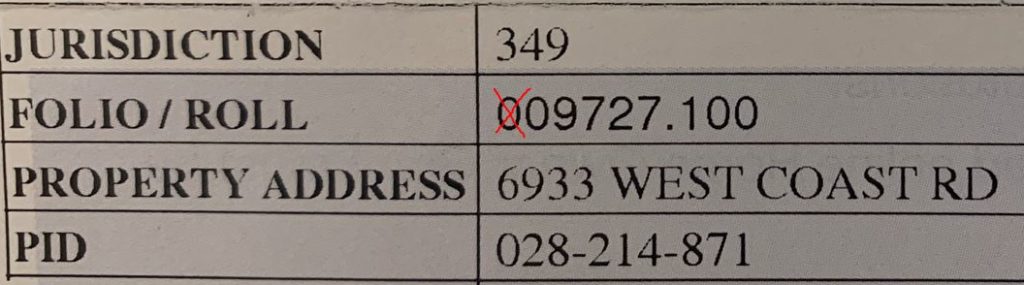

NOTE: When entering the folio number to file your home owner grant, remove the first zero:

What options are available to pay my taxes?

After your tax notice is received, please make payment before the July 2, 2024 due date to avoid penalties.

Online banking through Financial Institutions:

Pay online if your financial institution offers this service. Enter your folio number, minus the decimal, as your account number.

Should you choose to use this option of payment, your Home Owner Grant application must be received by July 2, 2024 or prior to avoid penalty. Home Owner Grant applications can be completed online before July 2, 2024 to avoid penalty.

In-Person At District of Sooke Municipal Hall:

The District of Sooke office is open Monday to Friday (excluding holidays) from 8:30 a.m. to 4:30 p.m. Cash, cheque and interact payments are accepted. Credit card payment is not accepted.

The Municipal office will remain open until 8:00 p.m. on Tuesday, June 25th and Thursday, June 27th for homeowners to make their tax payments. Please note that the Municipal office will be closed on July 1st (Canada Day).

After Hours Drop-off

A drop box is available for non-cash payments. It is conveniently located at the entrance to the municipal hall.

Payment by cheque

Please make your cheque payable to the DISTRICT OF SOOKE. Cheques may be postdated to July 2, 2024. Dishonoured cheques constitute non-payment of taxes and will be subject to penalty, interest and a $35.00 service charge.

Payment by mail

Payment (in Canadian dollars) must be received at the Municipal Hall by July 2, 2024. Mail early to avoid penalty. Mail lost or delayed by the post office will be subject to a penalty.

Payment by Mortgage Company

Your mortgage company will show on your tax notice and they will receive your tax information directly from the District of Sooke. If you are eligible for the home owner grant you are still required to submit your application online on or before July 2, 2024 to avoid penalty.

If not already set up on a pre-authorized payment plan: You can pre-pay your 2025 property taxes on a monthly pre-authorized basis starting August 1, 2024. The Property Tax Pre-Authorized Payment Plan is an optional payment plan that provides an opportunity for taxpayers to make equal monthly payments. Payments will be processed as 10 equal payments and collected on the first business day of each month, commencing in August of the year preceding the tax due date, and ending in May of the year in which the taxes become due. An 11th payment will be withdrawn for any property taxes still owing on the due date in July.

Additional Property Tax Payment Information

- Taxes in Arrears

Taxes in arrears (balance from last calendar year) are subject to interest under Provincial legislation. Properties with taxes in arrears will be sold on September 29, 2025 unless the taxes in arrears with interest are paid. - Delinquent Taxes

Taxes that are delinquent are subject to interest under Provincial Legislation. Properties with delinquent 2022 taxes will be sold on October 7, 2024 unless the delinquent taxes with interest are paid. - Interest

Interest on arrears and delinquent taxes is charged from January 1, 2024 to the date of payment. Please call the Municipal Hall at 250-642-1634 for the actual amount of interest owing.

How property assessments relate to property tax

Property assessments are mailed to all property owners in January each year.

It’s important to note that a property assessment increase doesn’t necessarily result in a significant increase in property taxes. What matters is how an individual property assessment changed in comparison to the average % change in property assessments in the municipality.

Questions about your assessment should be directed to BC Assessment – their contact information is below.

- A property owner with a larger-than-average property assessment increase could see an increase in their property taxes, while someone with a lower than average assessment increase could potentially experience a property tax decrease, depending on the tax rate.

- The overall district budget is developed based on the cost of delivering services to residents. Taxes collected by the District of Sooke support fire and police services, road maintenance, parks, and administrative and bylaw services.

- Of the property taxes collected by the District of Sooke, less than half remains with the district. The rest is collected on behalf of other taxing authorities, such as the Capital Regional District, schools, hospitals, BC Assessment, Vancouver Island Regional Library, and Municipal Finance Authority. The district does not control these charges.

- The District of Sooke does not determine property assessment values and cannot alter them. Property owners may appeal assessments by making an application to the BC Assessment Authority by January 31st by following the steps on the BC Assessment website or calling them toll-free at 1-866-825-8322

The following information from BC Assessment may also be helpful:

- Property Assessments and Property Taxes: A not-so-complicated relationship

- The Property Tax Equation

- BC Assessment Interactive Market Trend Maps

Contact BC Assessment:

- Toll-Free Number: 1-866-valueBC (825-8322)

- Outside North America Number: 604-739-8588

- Fax Number: 1-855-995-6209

- BC Assessment’s website www.bcassessment.ca

- BC Assessment’s YouTube channel

Home Owner Grant

The Home Owner Grant is one of the property tax assistance programs offered by the province. The program began in 1957 to help homeowners reduce the amount of taxes they pay on their home. Prior to 2021, it was administered by the District of Sooke. As of January 1, 2021, the Province of British Columbia will be administering the Home Owner Grant.

Starting January 1, 2021, local governments cannot accept retroactive or new applications for the grant and instead homeowners must go to www.gov.bc.ca/homeownergrant or call toll-free 1-888-355-2700.

School Taxes

The District of Sooke acts as the collection agency for school taxes. School taxes are paid to the Provincial government. The District of Sooke must pay the Province, even if the property owners do not pay their taxes. Municipalities have no control over the school tax rates. School tax rates are set by the Provincial government.

Tax Deferment Program

The British Columbia Tax Deferment Program is a low-interest loan program that may allow you to defer your annual property taxes. Tax Deferment programs are administered by the Province of British Columbia. For further information about the programs, including eligibility, please contact the Province of BC – Property Tax Deferment Programs.

Homeowners needing support to complete an application can phone 250-387-0555 or 1-888-355-2700 (toll-free).

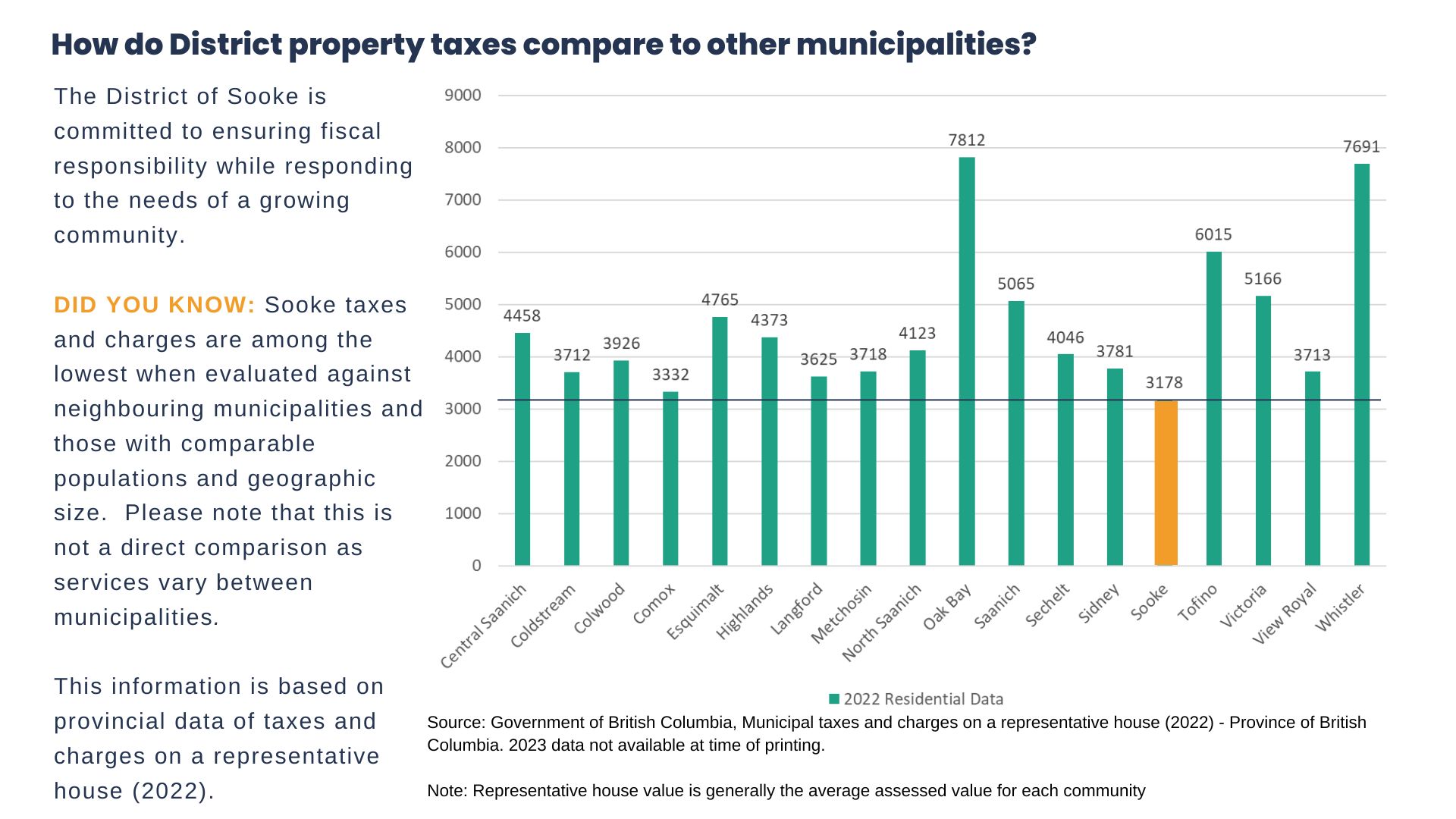

Putting Sooke Residential Property Tax in Perspective

There are many variations in the services each municipality provides, so while this makes it difficult to compare, the BC Provincial Government compiles information each year to assist with putting tax rates into perspective.

The full table can be found on the BC Government website:

Need more information?

Please contact Sooke Finance Department at finance@sooke.ca or 250.642.1634.