Development Cost Charges

Updated May 9, 2024

Development Cost Charges (DCCs) are monies that are collected from land developers by a municipality, to assist in financing the cost of upgrading or providing infrastructure services to support the new development. Imposed by bylaw under the Local Government Act, the charges are intended to facilitate development by providing a method to finance capital projects related to roads, drainage, sewers, water and parkland.

The District of Sooke undertook an update to its Development Costs Charges Bylaw from February 2021-June 2022. On June 13, 2022, DCC Bylaw No. 775, 2021 was adopted.

DCC Minor Update, Stakeholder session on Wednesday, April 10, 2024

The District of Sooke is currently undertaking a minor update to its Development Cost Charges (DCC) Bylaw to reflect updated project construction costs that encompass inflationary changes and the most recent tender prices.

As written in the Local Government Act and DCC Best Practices Guide, a minor DCC update can only consist of adjustments to project costs. Unlike a major update, a minor update does not allow for changes to the project list and growth projections. Both major and minor updates require engagement.

See the updated slides from the April 10, 2024 stakeholder session. Meeting notes will be posted as soon as they are available. It is currently anticipated a staff report will be presented for Council’s consideration at the May 13, 2024 meeting.

Once given three readings, the draft bylaw is sent to the Province for Ministerial Approval. Once Ministerial approval is received, the bylaw will return to Council for adoption.

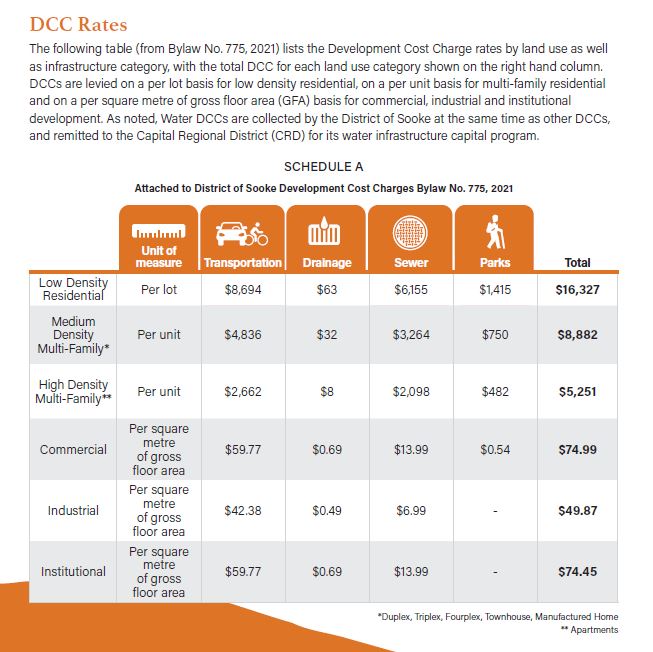

The proposed rates are outlined below:

| Land Use | Unit | Transportation | Drainage | Sewer | Parks | Proposed Sooke DCCs (Total) |

| Low Density Residential

(Single-Detached Residential) |

Per lot | $12,313.18 | $62.33 | $7,014.90 | $1,177.80 | $20,568.21 |

| Medium Density Multi Family

(Duplex, Triplex, Fourplex, Townhouse, and Manufactured Homes) |

Per unit | $6,849.21 | $31.17 | $3,720.02 | $624.59 | $11,224.99 |

| High Density Multi Family

(Apartments) |

Per unit | $3,770.91 | $7.48 | $2,391.44 | $401.52 | $6,571.36 |

| Commercial | Per m2 of gross floor area (GFA) | $84.65 | $0.69 | $15.94 | $0.45 | $101.73 |

| Industrial | Per m2 of GFA | $60.03 | $0.49 | $7.97 | $0.00 | $68.48 |

| Institutional | Per m2 of GFA | $84.65 | $0.69 | $15.94 | $0.00 | $101.28 |

DCC Rates

Frequently Asked Questions

DCCs are paid by applicants / developers at time of:

- Subdivision, for approval to create new single-family lots; or

- Building Permit, upon application to construct multi-family residential, commercial, industrial or institutional developments.

DCCs pay for the capital upgrades needed to support growth by assisting in the funding of:

- Transportation Infrastructure

- Drainage Infrastructure

- Sanitary Sewer Infrastructure

- Parkland Acquisition and Development

- Water Infrastructure (collected by Sooke on behalf of the Capital Regional District)

- Replacing infrastructure solely to service existing residents

- Operations and maintenance

- Community facilities such as recreation centres, libraries and fire halls

- Vehicles and equipment

The new DCC rates came into force immediately after the Development Cost Charge Bylaw was adopted by Council on June 13, 2022. However, the Local Government Act provides special protection from rate increases for development applications that are submitted prior to the adoption date. In-stream protection applies to complete building permit and subdivision applications that were received prior to the adoption of the new DCC Bylaw on June 13, 2022. Protection is also extended to complete rezoning and development permit applications that were submitted prior to the adoption of the new DCC Bylaw. The previous DCC rates will apply to any developments which receive final subdivision or building permit approval within 12 months of the adoption of the Bylaw. Therefore, if an application meets the required criteria of being submitted prior to the adoption of the new DCC Bylaw, it is provided protection from DCC rate increases until June 13, 2023 if final subdivision approval or building permit is obtained.

- Subdivision – at final approval

- Building Permit – prior to building permit issuance for townhouse, apartment, manufactured home or commercial projects (as defined in Bylaw No. 775)

While not technically a Development Cost Charge, the District also collects School Site Acquisition Charges on behalf of School District #62.

Where can I find out more information?

- Bylaw No. 775, Development Cost Charge Imposition Bylaw

- Development Cost Charge Background Report, 2021

- Development Cost Charge Bylaw Update 2021 Information page

- CRD Water DCC Bylaw – visit the CRD Website at www.crd.bc.ca