Home Owner Grant

Updated May 17, 2023

The Home Owner Grant is one of the property tax assistance programs offered by the province and, effective January 1, 2021, is administered by the province. The program began in 1957 to help homeowners reduce the amount of taxes they pay on their home.

What this means:

- The Province is entirely responsible for the homeowner grant program.

- Local governments cannot accept retroactive or new applications for the grant and instead, homeowners must go to www.gov.bc.ca/homeownergrant

- In order to avoid penalties and interest, apply before the July tax due date.

Get ready to apply

The best time to apply is after you receive your property tax notice in the mail and before your property tax due date.

- Wait to receive your property tax notice in the mail.

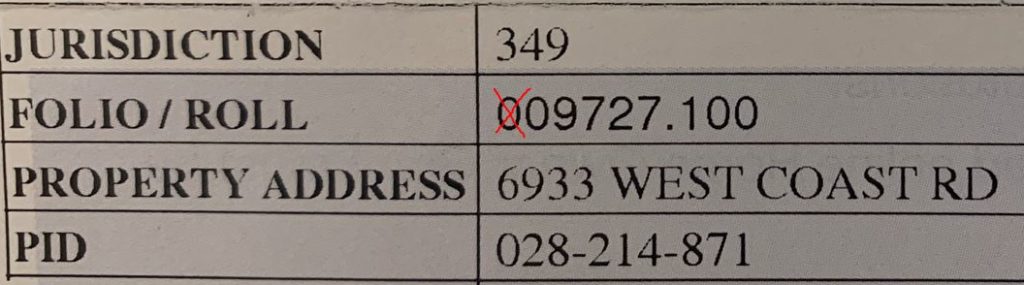

- Keep your property tax notice on hand. It has important numbers you’ll need to apply.*

- Once applications open, you can apply quickly and easily online or by phone at 1.888.355.2700.

NOTE: When entering the folio number to file your home owner grant, remove the first zero:

By centralizing this program within the B.C. government reports they will:

- Ensure homeowners receive the grant amount they are eligible for, such as the additional grant for seniors or persons with a disability.

- Automate the approval process for grants resulting in quicker application processing – this will help prevent ineligible homeowners from being penalized for late property tax payments.

Avoid Penalties

While this information is subject to change as new information is announced by the Province, typically your tax payment and Home Owner Grant application must be received on or before the first business day in July each year. Late, or delayed by mail, payments: are subject to a 10% penalty if not received by the July deadline.