Wednesday, May 12, 2021 – Earlier this year, the District of Sooke approved its five-year financial plan bylaw. After receiving notice from third-party agencies, the District set its 2021 Tax Rate Bylaw, which was adopted at the regular Council meeting Monday.

Putting Sooke residential property tax in perspective

There are many variations in the services each municipality provides, so while this makes it difficult to compare, the BC Provincial Government compiles information each year to assist with putting tax rates into perspective.

The information compares the amount a “representative house” in each municipality pays in residential taxes as well as other user fees.

The full table can be found on the BC Government website:

Taxes and Charges on a Representative House – 2020 (as 2021 provincial data is not yet available)

| Municipality | House Value | School | General Municipal | Regional District | Hospital | BCA, MFA, Other | Total Res Variable Rate Taxes | Total Res Parcel Taxes | Total Res User Fees | Total Residential Property Taxes and Charges |

|---|---|---|---|---|---|---|---|---|---|---|

| Central Saanich | 798,851 | 1009 | 2305 | 439 | 157 | 181 | 4091 | 0 | 952 | 5043 |

| Colwood | 664,853 | 980 | 1933 | 365 | 131 | 151 | 3,560 | 23 | 250 | 3,833 |

| Esquimalt | 730,488 | 928 | 2583 | 415 | 143 | 166 | 42,356 | 0 | 0 | 4,235 |

| Highlands | 842,393 | 1,241 | 1,986 | 234 | 164 | 369 | 3,994 | 0 | 0 | 3,994 |

| Langford | 646,677 | 953 | 1,527 | 400 | 127 | 147 | 3,154 | 0 | 0 | 3,154 |

| Metchosin | 794,496 | 1,171 | 1,442 | 225 | 156 | 325 | 3,319 | 0 | 0 | 3,319 |

| North Saanich | 1,037,406 | 1,310 | 1,545 | 399 | 204 | 235 | 3,693 | 100 | 520 | 4,313 |

| Oak Bay | 1,408,408 | 1,790 | 4,031 | 482 | 265 | 319 | 6,887 | 0 | 1,417 | 8,304 |

| Saanich | 896,463 | 1,139 | 2,762 | 210 | 176 | 203 | 4,490 | 0 | 1,254 | 5,744 |

| Sidney | 780,102 | 985 | 1,821 | 388 | 153 | 177 | 3,524 | 195 | 689 | 4,408 |

| Sooke | 521,784 | 769 | 1,351 | 483 | 102 | 118 | 2,823 | 653 | 0 | 3,476 |

| Victoria | 884,826 | 1,124 | 2,756 | 206 | 174 | 201 | 4,461 | 40 | 979 | 5,480 |

| View Royal | 769,193 | 977 | 1,751 | 186 | 151 | 174 | 3,239 | 0 | 596 | 3,835 |

What capital projects will take place in 2021?

Please review the 2021-2025 Five Year Financial Plan for full details about service increases, capital projects and special initiatives.

A few examples include:

- Church Road Design and Construction – phase one:

- reconfiguring the road cross-section at Church Road and Highway 14 to include a bike lane and a turn lane to address long queue times at the intersection during peak hours.

- Throup Connector Design (Charters to Phillips):

- Design as reported in the Transportation Master Plan: “extending Throup Road to connect Charters Road and Phillips Road. This will provide a connection between Phillips Road and the Town Centre as an alternative to Highway 14 and is the first section of the “Grant Road Connector” project that is included in the MOU between the District and the Ministry (TMP, p. 41).

- Installation of EV Charging Station on Eustace Road

- Design and construction of a fenced dog park

- Design and construction, in coordination with SEAPARC, of a multi-use sports box

What core services do tax dollars fund?

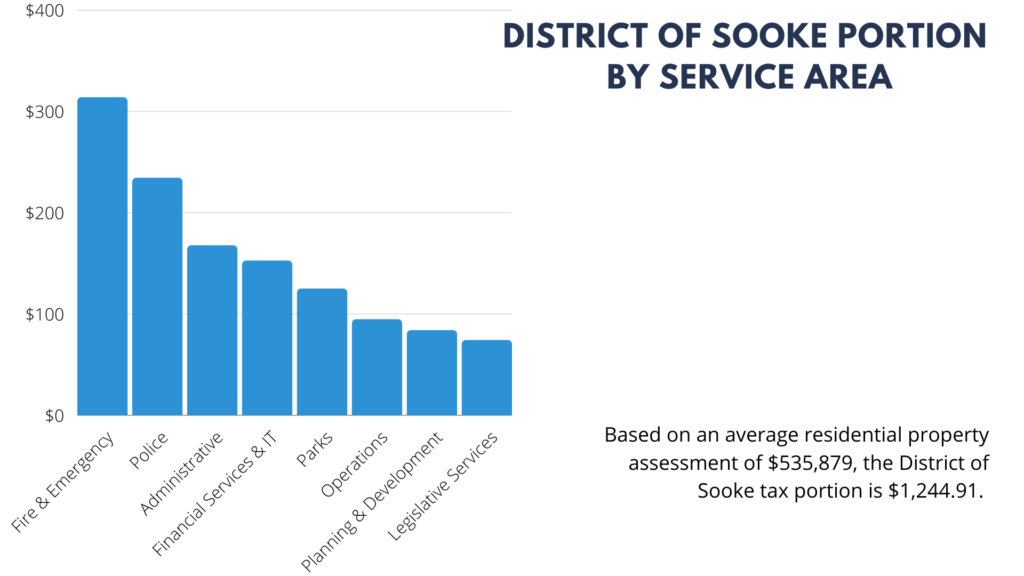

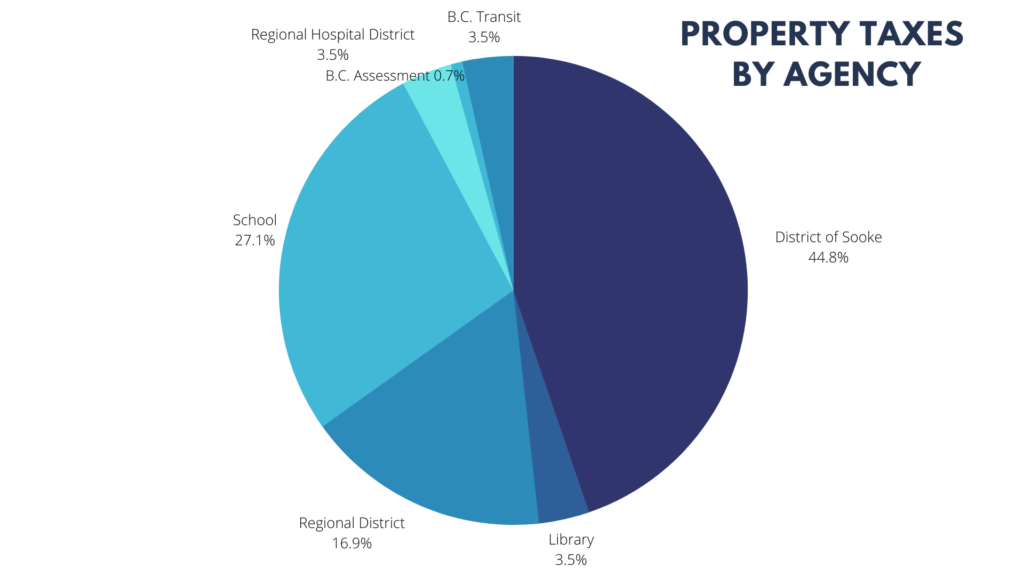

The District is Sooke is responsible for fire services, District park maintenance, roads, planning and development services, bylaw, wastewater treatment, and administration including financial and legislative services. 44.8% of tax dollars collected by the District go towards these services areas. The remaining 55.2% of taxes are disbursed to third parties.

What is the distribution of tax dollars to third parties?

Property taxes collected by the District, include those collected on behalf of third-party agencies. The distribution of these funds are (rounded):

- School: 27.1%

- Regional District: 16.9%

- Library: 3.5%

- BC Transit: 3.5%

- Regional Hospital District: 3.5%

- BC Assessment: 0.7%

- Municipal Finance Authority: 0.004%

Quick facts, in 2020:

- Bylaw services responded to 382 concerns

- Operations issued 213 Highway Use Permits

- 669 calls for service were received – calls for service including tending to street concerns, responding to hazardous trees, pick up garbage, etc.)

- Planning received 58 applications (Zoning, Development, Variance, etc.) and conducted 28 pre-development meetings

- Building safety issued 238 building permits and completed 1733 inspections

- Fire responded to 734 calls and conducted 197 inspections

Learn more:

- District of Sooke Property Tax Information

- District of Sooke Budget Open House Video

- District of Sooke Financial Information

- District of Sooke Property Tax Calculator

- Province of BC Municipal Tax Information

Property tax notices will be mailed at the end of May. Payment is due July 2, 2021. Residents are reminded that the province is now processing home owner grants. To apply, residents may visit gov.bc.ca/homeownergrant or call toll-free 1.888.355.2700.

Financial planning is a year-long process, beginning with a service-level review in August. Later this year the conversation will be launched through Let’s Talk Sooke, at letstalk.sooke.ca. To be notified of engagement opportunities, residents are invited to subscribe at sooke.ca > online services > subscribe.

Contact:

Christina Moog, Communications Coordinator

250.642.1634, ext. 678

cmoog@sooke.ca

2021 Property Tax Information Charts

The District’s tax notice contains levies and charges for other agencies. The District is obligated to collect those taxes. Approximately 55% of the amounts collected on the annual tax notice are sent to other government bodies and the District has no control over the amounts collected on behalf of these other agencies

Your tax dollars at work: Council allocates the District budget in alignment with strategic priorities. Funds are distributed to the District’s core service areas as captured in the chart below.