Thursday, December 16, 2021 – After receiving input from the community through the Citizen Budget Survey and the December 1st Budget Open House, the District adopted its 2022-2026 five-year financial plan at the December 13th Regular Council Meeting. Based on the average residential property assessment, the plan identifies a residential property tax increase of approximately $100 per year or $8.33 per month to fund District services next year.

Listening to the community, we heard about the need to improve local road infrastructure and continue with the implementation of the Transportation Master Plan, proceed with implementation of the Parks and Trails Master Plan and implement adaptation and mitigation strategies to respond to the climate emergency.

- 2022 Non-Property Tax Revenue Increases:

- Development Cost Charges, $200K

- Building permits, $150K

- Investment Income, $34K

- Infrastructure Projects:

- Church Road Roundabout, $276K funded by property taxes (Transportation Master Plan implementation)

- Road paving program, including Connie and Manzer Road, up to $700K (reserve funds) (Transportation Master Plan implementation)

- Wastewater Treatment Plant Expansion ($4.6 million in grant funding)

- Multiple Road Design Projects (e.g. Throup, Charters, Phillips, West Coast Road)

- Electric Vehicle Charging Stations, $50K plus BC Hydro partnership

- Parks & Trails Master Plan Implementation:

- Whiffin Spit Master Plan, $75K

- Completion of multi-use sports box, $375K

- Park and greenspace expansion through developer contributions, additional Parks Auxillary Workers

- Staffing – 3 new positions funded from non-market change (not property taxes), $270K:

- Manager of Engineering

- Firefighter

- Increase budget for Parks auxiliary workers

- Outside agencies:

- Visitor Centre, $5.4K (COVID restart funding)

- SD62 Healthy Schools, $5K

- Sooke Family Resource, $30K (note: funded with COVID for 2022 & 2023 – and may be a property tax increase in 2024 if supported by Council to extend the contract at that time)

- Council:

- Reduction in travel, $5K savings

- Reduction in contingency, $20K savings

- Reduction in Sooke Canada Day funding, $10K savings

- Increase in funding for community support and Service Agreements, $10K

- Administrative Services (CAO):

- Climate Action, $109K

- Reduction of legal, $18K

- Corporate Services:

- Election, $27.5K

- VoterView Software, $11K (COVID restart funding)

- Finance/IT

- Insurance, $35K

- Planning

- Reduction with completion of OCP review and contractor fees, $145K

- Operations

- Roads maintenance increase, $35K

- Asset Management Grant Contribution, $15K

- Reduction of contractor fees, $35K

- Fire

- Paid-on Call, $72K

- CREST, $16K

- Reduction in relief worker remuneration, $16K

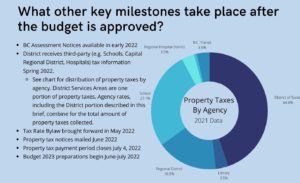

- BC Assessment Notices will be available in early 2022

- The District receives third-party (e.g. Schools, Capital Regional District, Hospitals) tax information Spring 2022

- Tax Rate Bylaw will be brought forward in May 2022

- Property tax notices will be mailed June 2022

- Property tax payment period closes on July 4, 2022

- Budget 2023 preparations begin June-July 2022

View Budget Brief (PDF), click the images below to enlarge.

During the 2022 Budget Conversation, residents submitted questions by phone, email and through letstalk.sooke.ca/budget – questions and answers to residents’ questions are provided through the Let’s Talk Sooke Budget information page.

Residents are reminded to subscribe to receive public meeting notifications, attend meetings in person at the Council Chamber in Municipal Hall, or view online through the District’s YouTube channel.

Each year the District completes a service-level review and citizen budget survey to inform the District’s budget. For 2023, this is tentatively scheduled for June 15th to July 15th. Staff will be available at local markets and provide residents with numerous opportunities to provide input in person, online, by phone or through print surveys.

Learn more:

- View Budget Brief (PDF)

- 2022-2026 five-year financial plan (consolidated summary)

- 2022 Capital Projects

- 2022-2026 Financial Plan Bylaw, Bylaw No. 835

- Budget and Financial Services Information Page

- Property Tax Information Page

- Budget Update, November 5, 2021

- Budget Update, October 28, 2021

- What We Heard – Budget Engagement 2022

Contact:

District of Sooke Finance Department

250.642.1634